On September 28, Boao Forum for Asia (BFA) held the Second Conference of International Science, Technology and Innovation Forum (ISTIF). As a major forum of the conference this year, the session “Capital Boosts Scientific and Technological Innovation” was successfully held online.

The session was hosted by Yanqing Yang, Director of the Planning and Development Department of Shanghai Artificial Intelligence Laboratory and Visiting Professor at Fudan University. During the session, representatives from international organizations, government departments, research institutions, enterprises and academia expressed their views on the topic of "Promoting the deep integration of finance and science and technology innovation". This session aims to contribute a “Boao solution” to promote effective financial services for science, technology and innovation (STI), and to support society with high-quality and sustainable development.

Diana Choyleva

Diana Choyleva, founder and chief economist of Enodo Economics, commented highly on China’’s development achievements in the field of STI in the past 40 years. She pointed out that China’’s financial sector has progressed along with rapid economic and social development. Also, it has played an important role in promoting economic prosperity, which meets the financing needs of enterprises and supports STI. To further optimize resource allocation, enhance efficiency and promote sustainable development, Choyleva suggested that banks should be promoted to increase credit support for SMEs and help them innovate and develop.

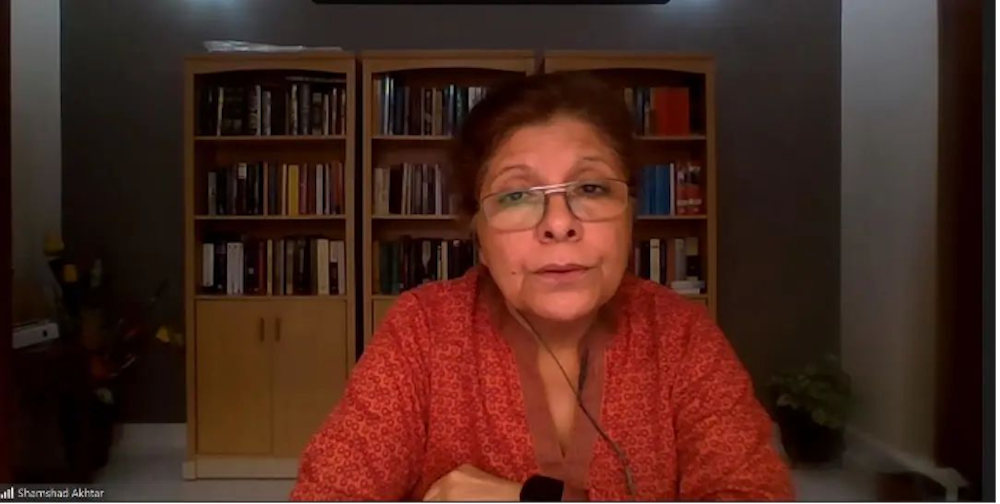

Shamshad Akhtar

Shamshad Akhtar, a member of the Advisory Committee of Boao Forum for Asia, also the former UN Under-Secretary-General and Executive Secretary of the Economic and Social Commission for Asia and the Pacific, pointed out that innovation is particularly important for the country’’s transformation and development. In her words, innovation provides strong support for strengthening core competitiveness and better integration into the international market. While STI is inextricably bound up with capital support, the government plays a crucial role in this regard which leads and drives the whole society to invest in innovation by playing the function of leveraging financial resources.

Guoying Cao

Guoying Cao, deputy director of the Department of Resource Allocation and Management from the Ministry of Science and Technology of the People′s Republic of China, commented that the new round of scientific and technological revolution and industrial change is progressing rapidly, thus urgently demanding a strong financial boost. The modern financial system also requires technology to exploit new growth opportunities, and the combination of technology and finance possesses a non-linear effect on industrial transformation and upgrading.

Cao stated that the current main contradiction faced by China’’s economic operation and the capital market remains on the supply side. As the result, it is necessary to deepen the structural reform of the financial supply side and improve the ability and level of the financial system to serve science and technology. Also, to promote the coordinated development of science and technology with the economy, to achieve a high-level cycle of science and technology, industry and finance, so that the capital market can act as a hub that drives STI and the transformation of the real economy.

Cao further suggested that in the future, breakthroughs could be sought in the strengthening of investment services, the establishment of a sound technology valuation system from a financial perspective, and the continuous innovation of technology finance derivatives and models to promote more funds reaching the field of technology innovation.

Fenglei Fang

Fenglei Fang, Founder and Chairman of Hope Group, shared his views on how the government and the market can collaborate to assist technology and innovation through financial means. He believes that the success of technology and innovation is a probability event and that the mainstream technology route should be chosen by market forces. In his opinion, investment in STI by financial institutions can diversify the risks of different technology lines and provide better services to the invested enterprises. Using government funds as a mother fund to support the market-tested angel funds and private equity funds, indirect investment in STI should be the optimal choice.

Xianfeng Ma

Xianfeng Ma, CEO of CCX Group, former Vice President of China Institute of Finance and Capital Markets and Vice President of Beijing Green Finance Association, spoke on the topic of "Capital market supports the development of green low-carbon STI". He pointed out that addressing climate change to promote green recovery and development has become a global subject in the post-epidemic era. The development of green technology enterprises represents a crucial aspect in addressing climate change and carbon emission reduction. In Ma’s words, being a power source to support the development of green and low-carbon STI, a multi-level capital market system can provide diverse financing services for green STI enterprises and facilitate the development of STI enterprises.

Ma suggested that China’’s capital market has made significant achievements in supporting the development of green and low-carbon enterprises. In terms of stock financing, as of July this year, the domestic Science and Technology Board and Growth Enterprise Board have more than 180 listed companies in new energy and energy conservation and environmental protection. Meanwhile, the Initial funds and Refinance totalled more than 170 billion yuan, with more than 250 companies registered on the New Third Board. In the green bond market, there has been rapid development since 2017, with a financing scale of 2.6 trillion yuan. Looking at the investor side, the securities fund industry is becoming more and more involved in green investment. Taking public funds as an example, there are more than 200 green-themed public funds operating in the whole market in July this year, with a deposit scale of more than 420 billion yuan, covering various aspects such as ESG, environmental protection, low carbon, new energy, environmental protection equipment, engineering and services.

Zhaojia Ye

Zhaojia Ye, Member of the Macao Committee for the Guangdong-Hong Kong-Macao Greater Bay Area Development, Vice President of the Bank of China Macau Branch and Chairman of the Macau Banking Association, introduced the financial situation in Macau and the development of Hengqin-Guangdong-Macao Integration.

At present, the construction of Macau’’s bond market has shown accelerated development, with the scale of issuance and listing reaching 300 billion MOP in two years. In particular, after the release of the overall plan for the Guangdong-Macao In-depth Cooperation Zone in Hengqin, the governments and the management committee of the in-depth cooperation zone have formed a consensus that intensive policies have been introduced to enhance the efficiency of bond issuance, increase the attractiveness of financial institutions to issue bonds in Macau, and continuously provide new sources of funding for technology financing needs.

Lijun Zhang

Lijun Zhang, partner of PwC China’’s regional economic and finance industry, spoke on the topic of "Financial support for green technology development". He pointed out that China’’s current development of green technology is relatively fast, and financial support for green technology has achieved phased results. Considering that new power systems, large-capacity wind power and high-efficiency photovoltaic, low-cost renewable hydrogen production, as well as other "low-carbon, zero-carbon and carbon-negative" frontier technologies and equipment research and development, are expected to enter an explosive development stage, China should systematically promote the balanced development of green technologies between industries in both carbon sources and carbon sinks, and make efforts to change the status quo of green technology patent quality, international influence and layout, which are still relatively weak.

Zhang further suggested that green technology assessment and certification standards should be continuously improved and regularly revised, and the development of a domestic carbon asset pricing system should be accelerated - bridging the domestic market and the associated international market to lay a solid foundation for the financial system to further support green technology.

Wei Zhang

Wei Zhang, CEO of China Great Wall Securities, believed that "Technology + Capital + Industry" is the golden triangle that supports innovation-driven development, and has gradually become the golden key to cultivating the core competitiveness of enterprises and even the country. Given the new historic opportunities, industrial securities companies with industrial and technological genes will embrace a broader space for development and have richer paths and means to serve the real economy, which will in turn be more closely integrated into the national strategy and resonate with technological innovation and industrial development. In Zhang’s words, it is believed that industrial securities will emerge from finance and reach industry, and play an increasing role in serving industrial innovation and development by relying on industrial background and resources.

Yanqing Yang

In the discussion session afterwards, Shamshad Akhtar, Guoying Cao, Fenglei Fang and other guests successively participated in the discussion. There was a continuous clash of ideas on topics such as the relationship between public and private investment, cross-border capital flows, and guiding PE to achieve industrial planning. In the end, the guests expressed their views and expectations on the biggest breakthroughs that can be achieved by the capital market to support the development of STI.